Summary

The Invisible Governor

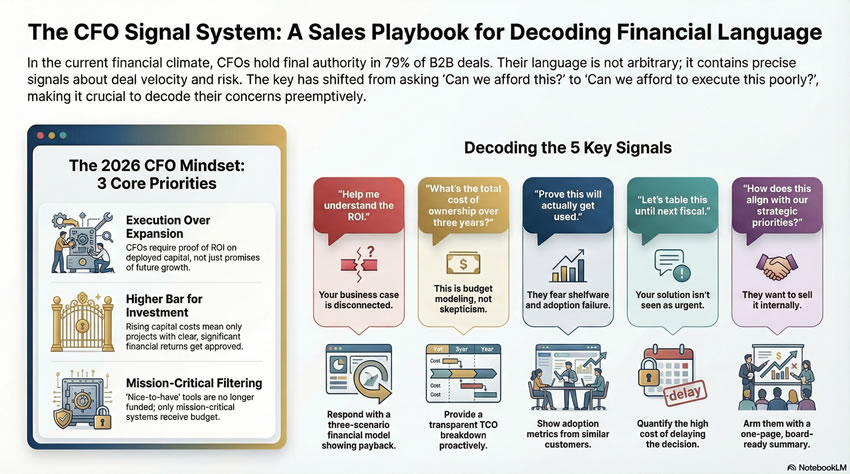

In 79% of B2B purchases, the CFO holds final decision authority. Yet most sales organizations treat CFO engagement as binary: budget approved or deal killed.

The data reveals something more precise. CFO involvement adds an average of 2 to 4 weeks to enterprise sales cycles, but the language CFOs use during this period predicts outcome with measurable accuracy. Specific phrases telegraph intent, concern depth, and the exact type of evidence required to advance the deal.

The constraint is not CFO skepticism. The constraint is misreading what CFOs are actually asking for.

The 2026 Financial Context: What Changed

CFO behavior in 2026 reflects three structural shifts from prior fiscal periods.

Execution over expansion

After twelve months of AI investment cycles without demonstrated ROI, CFOs now face board-level pressure to show returns on deployed capital. Every dollar allocated requires explicit value justification tied to measurable business outcomes.

Capital cost reality

With treasury yields holding at 4.5%, the cost of capital has reset expectations. Investment hurdle rates have risen accordingly. Projects that cleared approval thresholds in 2023 would not clear them today.

Mission-critical filtering

Gartner’s December 2025 B2B buying research showed that 87% of enterprise technology buyers now segment purchases to distinguish mission-critical systems from discretionary tools. The “nice to have” category no longer receives budget allocation during planning cycles.

The question CFOs are asking has shifted. It is no longer “Can we afford this?” It is “Can we afford to execute this poorly?”

Your response must address execution confidence before financial return.

Signal #1: “Help me understand the ROI here”

Classification: Stall Risk

This phrase is not a request for additional calculation. It is a signal that your business case has not connected to their specific financial reality.

What the constraint reveals

The CFO cannot see how your solution maps to their profit and loss statement. Your internal champion has not built a credible financial argument that survives executive scrutiny. Or you are being compared to alternatives, and differentiation on financial terms has not been established.

The intervention required

Build a three-scenario financial model that acknowledges uncertainty while demonstrating value across plausible outcomes. Conservative, expected, and optimistic cases should map to their fiscal calendar, not your deployment timeline. If Q1 deployment leads to Q3 measurable results, state this explicitly.

Show break-even timeline with precision: “Payback in seven months, conservative case, assuming 15% deployment friction.”

Include comparative cost analysis that quantifies the status quo. Lost revenue and operational inefficiency have dollar values. Alternative solutions have implementation costs beyond licensing. Your solution’s total cost must include deployment reality, not just contract value.

Risk-adjusted return frameworks acknowledge what CFOs already know: deployment risk exists. Stating “Given 15% deployment risk, expected value remains $427K” signals you have seen implementations fail and designed around that reality.

Response template

“[CFO Name], attached is a three-scenario financial model built on [Company]’s current [specific metric]. Conservative case shows seven-month payback. Expected case delivers $XXX in Year 1 measurable value. I have included risk-adjusted returns that account for deployment challenges we observed in similar enterprise rollouts. Let me know which assumptions would be most useful to discuss.”

Signal #2: “What’s the total cost of ownership over three years?”

Classification: Buying Behavior

This is not skepticism. This is budget modeling. The CFO is allocating capital across fiscal periods and must defend this line item against competing priorities.

What the constraint reveals

The deal is real. They are planning capital allocation timelines. They need ammunition to defend this spend during budget review cycles. They are concerned about cost elements that emerge after contract signature: implementation complexity, training requirements, ongoing maintenance burden, integration costs.

The intervention required

Provide transparent TCO breakdown that includes every cost element. Year 1 should itemize license fees, implementation services, training programs, and any integration work required. Years 2 and 3 should show recurring costs with realistic growth assumptions as usage scales.

Include comparison to alternatives. If build versus buy is a consideration, quantify internal development costs honestly. If competitive alternatives exist, show TCO comparison without naming competitors directly.

Quantify the cost of delayed decision. Waiting six months has an opportunity cost. State it: “Delaying implementation to Q3 costs $XXX in unrealized operational value based on current [specific metric].”

If flexible payment structures exist (annual versus multi-year commitments, performance-based pricing, phased rollout options), present them. CFOs are modeling budget impact across multiple quarters. Give them options that fit their capital planning constraints.

The pattern

Proactive TCO analysis signals transparency. Send it with the initial proposal, not in response to the question. This alone differentiates you from vendors who hide cost complexity until later stages.

Signal #3: “We need to see proof this will actually get used”

Classification: Deployment Risk

This is the CFO’s primary 2026 concern. Shelfware. Underutilized licenses. Six-figure investments that never achieve projected adoption. They have been burned. Adoption risk now kills more deals than budget constraints.

What the constraint reveals

Previous technology purchases at this organization did not deliver promised value. End-user adoption fell short of projections. The CFO is skeptical that deployment plans survive contact with organizational reality. They need evidence of successful change management, not feature presentations.

The intervention required

Show adoption metrics from comparable customers. “Companies with similar [specific characteristic] see 85% daily active users within 90 days” is specific. Show the usage ramp curve: Week 1 baseline, Month 3 steady state, Month 6 power user emergence.

Include structured onboarding plans with accountability. 30/60/90-day rollout timeline. Dedicated customer success management for the first six months. Success milestones with explicit commitments: “If adoption falls below 80% by Day 60, we will [specific intervention].”

Pilot proposals de-risk the decision. “Start with one team, prove value against defined success criteria, then expand” gives CFOs a lower-risk path to budget commitment. Define pilot-to-production conversion timeline upfront.

The critical distinction

Do not just demonstrate you can deploy. Demonstrate you have successfully deployed for organizations facing similar change management constraints. Reference specific customer examples with comparable complexity, user base characteristics, and deployment timelines.

Signal #4: “Let’s table this until next fiscal year”

Classification: Priority Failure

This is rarely about budget availability. It is about strategic urgency. You have not made this purchase mission-critical. Other initiatives have clearer strategic value. The CFO needs political cover to deprioritize without explicitly rejecting the proposal.

What the constraint reveals

Your solution occupies the “nice to have” category. Competing initiatives have stronger strategic alignment. The CFO lacks the internal ammunition to prioritize this spend over alternatives. They are protecting budget for higher-priority commitments.

The intervention required

Build cost of delay analysis with precision. Quantify the monthly or quarterly cost of maintaining status quo. “Delaying six months means $XXX in unrealized value based on [specific operational metric]” makes inaction visible.

Show competitive displacement risk. “Direct competitors are deploying similar capabilities now. Twelve-month delay creates [specific strategic disadvantage]” reframes timing as competitive positioning.

Propose bridge structures that defer payment while enabling progress. Start implementation now, defer majority of payment to next fiscal period. Run pilot this quarter, prove value, secure next year’s budget allocation with demonstrated results rather than projected outcomes.

Engage executive sponsorship at peer level. Your CEO writing to their CEO reframes the conversation from vendor transaction to strategic partnership. Offer board-level briefing on the solution’s strategic implications.

The timing reality

If you are hearing this signal in Q4, you engaged too late. CFO budget planning cycles begin in Q1 and Q2. Engaging during budget formation gives you influence. Engaging after budget allocation requires displacing existing commitments.

Signal #5: “Can you walk me through how this aligns with our strategic priorities?”

Classification: Internal Champion Behavior

CFOs do not ask this question unless they are personally invested in the outcome. They are preparing to champion your solution to the board, the CEO, or executive leadership. They need language to sell it internally.

What the constraint reveals

They see the value but lack the narrative framework to defend it during strategic review. They are connecting your solution to company-wide objectives. They need you to help them win the internal political conversation.

The intervention required

Create strategic alignment documentation that maps your solution to their stated strategic objectives. Reference CEO earnings call language, annual report priorities, board-level goals. Show how you accelerate their strategy, not just solve a tactical problem.

Build board-ready executive summary. One page. Strategic rationale, financial impact, risk mitigation. Anticipate board questions and answer them preemptively. The CFO should be able to forward this document without modification.

Consider customer advisory board invitation. Offering the CFO a seat on your advisory board positions them as thought leader, not just customer. This creates peer network effect where other CFOs validate the decision through shared participation.

The acceleration move

Offer to present directly to the CEO or board on strategic value. Few vendors propose this. It signals partnership depth and confidence in strategic alignment. It also gives the CFO political cover: they brought in external strategic perspective rather than making a unilateral vendor selection.

Pattern Recognition: Reading System State

Individual signals matter. Signal patterns reveal system state.

Stall indicators

Vague timeline references (“We will revisit this”) without specific dates. Requests for additional data after comprehensive analysis has been provided. Delegation to junior analysts after initial executive engagement. Comparison paralysis without stated decision criteria.

Momentum indicators

Specific operational questions: implementation details, payment term options, contract length scenarios. Introduction of additional stakeholders: “Let me loop in our head of IT.” Timeline urgency with specific milestones: “We need this operational by Q2 to hit [specific business objective].” Reference requests to speak with comparable customers.

The meta-signal

CFO response time predicts priority. 24-hour response indicates active engagement. 48-plus hours suggests deprioritization. Week-long silence means the deal has stalled and requires intervention to restart momentum.

The Governing Principle

CFO involvement in enterprise sales is not binary approval mechanics. It is a negotiation system where concerns are telegraphed through specific language patterns.

Learning to decode these signals allows you to address objections before they calcify into blockers. Proactive financial rigor (three-scenario models, transparent TCO breakdowns, adoption proof) differentiates you from competitors who wait for questions before providing evidence.

The best enterprise sellers do not react to CFO concerns. They anticipate them, address them preemptively, and provide the financial and operational evidence CFOs need to champion deals internally.

Because in 2026, CFOs are not asking whether you can deliver value. They are asking whether you can help them execute flawlessly. Answer that question with evidence, and deal velocity increases while competitors stall on objections they never saw coming.

Quick Reference: Signal Response Matrix

| CFO Signal | Type | What It Reveals | Required Response |

|---|---|---|---|

| “Help me understand the ROI” | Stall Risk | Business case disconnected from their P&L | Three-scenario model with risk-adjusted returns |

| “What’s TCO over three years?” | Buying Behavior | Modeling budget allocation across fiscal periods | Transparent TCO breakdown with payment options |

| “Prove this will get used” | Deployment Risk | Fear of shelfware and adoption failure | Adoption metrics, onboarding plan, pilot proposal |

| “Table until next fiscal” | Priority Failure | Not mission-critical, competing priorities | Cost of delay analysis, bridge proposal, exec sponsor |

| “How does this align with strategy?” | Champion Behavior | Building internal case, needs your help | Strategic alignment doc, board summary, CAB invite |

References

- Gartner. (December 2025). B2B Buying Research: Enterprise Technology Purchase Patterns. https://www.gartner.com/en/sales/research/b2b-buying-research

- Forrester. (October 2025). The State of Business Buying 2025. https://www.forrester.com/research/b2b-buying-research/