Summary

Why Winning B2B Organizations Redesign Strategy Around Buying Groups and Influence, Not Leads and Channels

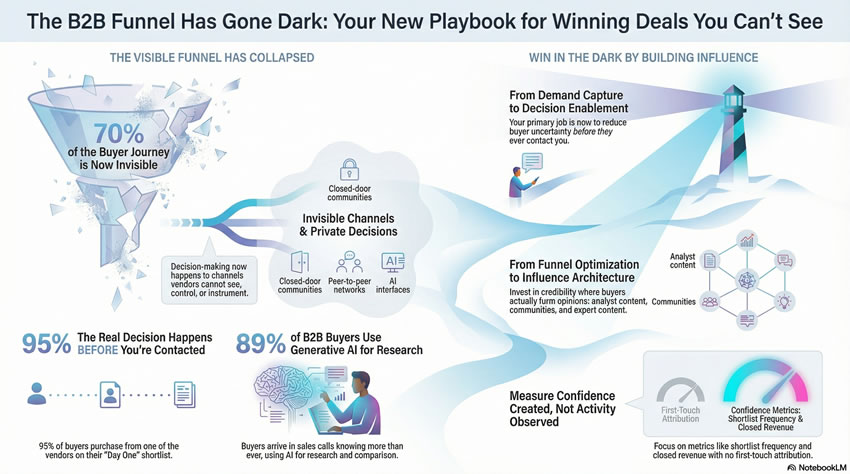

In 2023, marketing leaders believed better attribution would restore visibility.

By 2026, the opposite occurred.

As buying became more digital, more self-directed, and more AI-mediated, the most consequential moments in the decision process moved outside observable systems entirely.

The response has been predictable: more tracking pixels, more intent data vendors, more attribution models. Each promises to illuminate what remains dark.

None address the actual problem.

The highest-value B2B deals are now shaped primarily in channels vendors cannot see. The loss of visibility is structural, not temporary. And the organizations winning these deals have stopped chasing measurement and started redesigning strategy around buying groups and influence instead of leads and channels.

This is not about accepting blindness. It is about understanding what actually drives B2B revenue in 2026.

The Collapse of Behavioral Exhaust as Signal

Marketing did not lose insight because tools degraded.

It lost insight because it confused behavioral exhaust with buyer intent.

For years, marketers benefited from an anomaly. Buyer research happened on owned websites, trackable search engines, and public social platforms. What was measurable felt complete. What was visible was assumed to be representative.

That assumption was always wrong. It simply took time to become obvious.

As buyers adopted privacy controls, private collaboration spaces, AI research tools, and peer networks, the observable layer thinned. But real decision-making did not slow. It intensified—elsewhere.

Senior teams now report a paradox: pipeline quality is strong, deal velocity is improving in segments, yet pre-pipeline visibility has collapsed.

The data explains why.

According to 6sense’s 2025 Buyer Experience Report, buyers do not engage sellers until they are two-thirds of the way through their journeys.[^1] The typical buyer is 70 percent through decision-making before reaching out. Eighty percent initiate contact themselves.[^1]

More revealing: In 95 percent of cases, buyers purchase from one of the four vendors on their Day One shortlist.[^1]

The buying decision precedes the buying process vendors observe.

Attribution did not fail. The assumption that vendor-visible activity represents the buying journey failed.

How Buying Actually Happens Now

The funnel has not disappeared.

It has fragmented, externalized, and compressed.

- Externalized: Decision work now happens in analyst content, AI tools, communities, referrals, and private conversations—spaces vendors do not control and cannot instrument.

- Nonlinear: Buyers loop between synthesis, validation, and justification repeatedly, never entering a vendor-managed process until confidence already exists.

- Compressed at entry: When buyers finally surface, they arrive with shortlists formed, constraints defined, urgency established.

The term practitioners use is “dark funnel”—the places where buyers engage and make decisions that no attribution software can account for.[^2]

This is not theory.

Research from Gartner and industry analysts estimates 70 percent of the B2B buyer journey now happens in this invisible layer.[^2]

According to Google’s October 2025 research, 60 percent of B2B buyers use tools like ChatGPT or Gemini to augment vendor lists, summarize content, and surface competitors.[^3] They enter vendor meetings knowing more than sales teams expect.

Forrester’s 2024 data confirms the magnitude: 89 percent of B2B buyers have adopted generative AI, naming it one of the top sources of self-guided information in every phase of buying.[^4] Adoption is occurring at three times the consumer rate.

The dark funnel is not a gap in your data. It is where buying actually occurs.

Buying Groups Form Before Vendors Engage

Marketing strategies still assume vendors help buyers form consensus.

The reality: consensus increasingly precedes contact.

Buying groups assemble internally and externally. Influencers include peers, analysts, AI outputs, former colleagues. Vendor engagement triggers only after internal confidence reaches threshold.

Gartner research shows 73 percent of B2B buyers report significant decision-making happens outside vendor touchpoints.[^5] The average B2B deal involves 25-plus touchpoints over ten months, with 11 or more stakeholders influencing the decision.[^6]

Forrester sharpens this further: more than 50 percent of younger buyers now include ten or more external influencers in purchase decisions.[^7] These are not vendor-provided references. They are practitioners found in communities, experts discovered through search, analysts accessed independently.

This matters because lead-based thinking collapses under buying-group reality.

Single-contact attribution misrepresents how confidence is built. The individual who fills out the form is rarely the person who initiated research, convinced stakeholders, or will make the final decision.

The highest-value intelligence flows through channels marketing cannot instrument: Slack channels where practitioners swap implementation stories, private LinkedIn groups where peers validate vendor claims, AI-powered research that synthesizes competitor comparisons without visiting vendor websites.

You cannot optimize what you cannot see. But you can design for how it actually works.

Revenue That Appears Without a Visible Funnel

Dark-funnel deals do not lack structure.

They reflect a completed structure that was invisible.

Pattern 1: The unsolicited, highly qualified inbound

No detectable intent signals. Immediate shortlist language. High keyword specificity.

Interpretation: Extensive off-platform research already complete.

Pattern 2: The accelerated form-fill

No prior observable activity. Urgency signals inconsistent with early-stage buying.

Interpretation: Internal alignment already achieved.

Pattern 3: The referral-triggered deal

No prior brand awareness. Immediate trust transfer.

Interpretation: Reputation substituted for discovery.

These are not anomalies. They are evidence of where influence accrues.

6sense data shows 84 percent of B2B buyers state self-service tools are “incredibly important” when choosing vendors.[^8] They expect to manage research, evaluation, and preliminary selection entirely alone. By the time they surface, evaluation is substantially complete.

More than half of large B2B transactions—those $1 million or greater—now process through digital self-serve channels.[^9]

The deals your attribution model calls “direct” or “organic” often represent buying journeys that happened entirely off-platform. The lack of attribution is not a data problem. It is confirmation the buyer used channels you do not control.

Traditional Marketing KPIs Now Distort Strategy

The problem is not that metrics are incomplete.

The problem is they optimize the wrong behavior.

Channel ROI assumes channel causality

If a buyer converts after clicking paid search, attribution credits the ad. But if that buyer spent three weeks in practitioner communities, consulted two analyst reports, and asked peers on LinkedIn before finally searching the brand name, the “channel” that generated the deal was influence architecture—not paid search.

MQL volume rewards early exposure, not late confidence

Marketing gets credit for capturing contact information at awareness. But the content that actually moved the buyer to shortlist—a detailed implementation guide, a transparent pricing breakdown, a candid analyst critique—often generates no MQL at all.

Attribution models penalize influence that works quietly

Podcasts that build authority over months. Ungated content that earns trust without forms. Peer conversations that transfer credibility. All generate pipeline. None receive attribution credit.

The organizational consequence is predictable: teams over-invest in visibility-producing tactics and under-invest in credibility-building systems.

According to Forrester’s 2026 predictions, 75 percent of enterprise B2B companies will increase budgets for influencer relations as buying groups increasingly rely on external experts.[^10] This is not consumer influencer marketing. This is strategic investment in the third-party validators buying groups actually trust.

The shift is already underway. The question is whether your measurement system recognizes it.

The Measurement Shift High-Performing Teams Make

Leading organizations are not trying to illuminate the dark funnel.

They are instrumenting outcomes around it.

High-performing teams now measure:

Buying-group role coverage within ICP accounts

Are we reaching economic buyer, technical evaluator, and executive sponsor across target accounts?

Time-to-first human conversation

How long from initial research signal to meaningful engagement?

Conversion velocity by entry mode

Do referrals close faster than outbound? Do dark-funnel inbounds convert at higher rates?

Shortlist mention frequency in discovery

When sales asks “Who else are you considering?”, how often are we on that list?

Proof asset usage in sales-assisted flows

Which technical documentation, ROI models, or implementation guides actually advance deals?

Ratio of unattributed pipeline that closes

What percentage of closed-won revenue has no first-touch attribution?

These metrics align to how confidence forms, not how clicks accumulate.

When Google reports AI-driven traffic now represents 2 to 6 percent of total B2B organic traffic and is growing at more than 40 percent monthly,[^11] traditional SEO metrics become insufficient. Forrester expects AI-generated traffic to reach 20 percent or more by end of 2025[^11]—likely an undercount given attribution technology limitations.

Organizations that reorient measurement around buying-group confidence, not individual lead behavior, can see what works even when traditional attribution breaks.

This is not accepting blindness. This is measuring what matters.

From Demand Capture to Decision Enablement

Marketing’s primary job is no longer generating interest.

It is reducing buyer uncertainty before contact.

The strategic shifts this requires:

From funnel optimization to influence architecture

Building presence and credibility in third-party channels where buyers actually form opinions.

From campaign calendars to persistent credibility

Creating authoritative content that compounds value over time rather than campaigns that expire.

From persona messaging to buying-group enablement

Developing materials that help entire buying committees reach consensus, not just educating individual contacts.

From content volume to decision relevance

Publishing fewer, higher-quality assets that actually move buyers from research to shortlist.

According to Forrester’s research, human expertise will rival generative AI in appeal as buyers seek deeper validation.[^12] In 2025, 30 percent of buyers viewed genAI tools as meaningful during final commit stage, but as genAI proliferates, buyers increasingly turn to experts to validate insights and answer complex questions AI cannot address.[^12]

This creates opportunity.

Organizations that position subject matter experts as accessible validators—not gatekeepers—win influence in buying groups that AI-mediated research brings to surface.

The constraint is not AI capability. The constraint is whether your organization can produce expertise worth citing.

The Real Risk: Designing Strategy for a Funnel That No Longer Exists

The dark funnel is not a blind spot to be fixed.

It is the dominant terrain of modern B2B buying.

Organizations that succeed will not chase lost visibility. They will:

Know their ICP with precision

If you cannot describe your ideal customer profile at the level of job-to-be-done, pain threshold, and buying-group composition, you cannot build influence where it matters.

Understand buying-group dynamics deeply

Map who researches, who evaluates, who approves, who implements. Different roles consume different content in different channels at different stages. Influence architecture requires this granularity.

Invest in influence that compounds quietly

The podcast episode that never generates an MQL but gets shared in Slack channels. The technical documentation AI tools cite when answering buyer questions. The analyst briefing that positions you favorably in third-party research buyers actually trust.

These create durable advantages because they work where buyers make decisions.

Measure success by confidence created, not activity observed

Forrester reports over 90 percent of buyers who used genAI to inform purchases of $1 million or more reported positive results.[^13] These buyers conduct extensive research, reduce biases, and evaluate wider ranges of providers than previous generations.

Organizations that help buyers reach confident decisions—even through channels they cannot fully track—win deals.

Organizations that optimize for trackable activity lose to competitors building influence in the dark funnel.

Strategy Must Follow the Buyer

The funnel did not go dark. It moved upstream, outward, and off-platform.

By January 2026, the bifurcation in B2B marketing is complete.

One cohort continues optimizing attribution models, increasing MQL targets, demanding better tracking.

Another cohort has accepted that the most valuable buyer activity happens beyond instrumentation and has redesigned strategy accordingly.

The second group is winning.

They understand that when 6sense data shows 95 percent of buyers purchase from their Day One shortlist, the entire marketing mandate changes. Getting on that list—through peer influence, AI-mediated research, analyst validation, and authentic expertise—matters infinitely more than optimizing the journey after buyers make contact.

They recognize that when Forrester documents 89 percent genAI adoption among B2B buyers and predicts 61 percent of organizations will use private AI engines to support purchasing,[^14] traditional content strategy becomes insufficient. Content must be structured for AI consumption, authoritative enough to be cited by AI tools, and valuable enough that humans validate AI-generated insights against it.

They acknowledge that when Gartner finds 73 percent of buying decisions happen outside vendor touchpoints, the concept of “demand generation” requires rethinking. The demand exists. The decision-making progresses. Marketing’s job is ensuring that when buying groups research, evaluate, and decide, the organization’s point of view, competitive differentiation, and implementation approach are present in the conversation—whether or not that conversation is visible.

This is not a measurement problem with a tracking solution.

This is a buying-system shift that requires a strategy transformation.

The dark funnel is where modern B2B revenue is generated. The question is not how to illuminate it, but how to win within it.